Fintechs in Canada understand the demanding situations that small business owners operate in. Cash flows don’t always keep pace with expenses and some customers may take time to make payments. This can cause a cash flow problem that fintech start-ups in Canada are hoping to solve.

Today, many small business owners are turning to financial technology companies and start-ups that specifically serve this sector when they have a cash flow issue. Traditional financial institutions have stringent lending policies that often make it difficult for small businesses to get advances and loans. This is especially true for businesses that are too big to borrow money from friends and family yet too small to approach banks. Under such circumstances, small businesses can rely on fintechs to get much-needed cash advances to help pay their expenses.

These financial technology companies provide cash advances of about 80 to 90 percent of the invoice value to customers so that they can meet their immediate and urgent business needs. Usually, the money is remitted within 24 hours into the business’s bank account.

FundThrough, a fintech that offers invoice financing, is one such example of fintechs helping small business owners. FundThrough CEO Steven Uster states that customers usually approach his company to avoid money issues when their taxes are due, and this can happen at any time of the year.

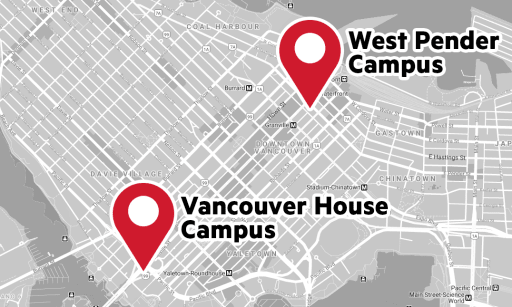

Vancouver-based accounting start-up Bench’s CEO, Ian Crosby, states that although alternative lenders may charge higher fees compared to banks, there is a good reason for it. Banks are generally lending to small businesses on their credit cards, which carry a much higher interest rate than the rate offered by the new-generation fintechs. This is why some small businesses prefer fintechs to traditional lending institutions.

There is no doubt that small business owners sometimes operate in challenging business environments. They need business acumen and knowledge to seize opportunities that come their way, and they must also use innovative thought processes to find solutions to business challenges so that they can succeed in a competitive marketplace. These are skills and expertise that small business owners can learn and acquire through the UCW MBA program.

The program equips prospective small business owners with the ability to come up with novel solutions to challenges, learn the nuances of finance, and operate with diverse teams to ensure projects and tasks are completed successfully. UCW MBA graduates become effective leaders who can drive and guide workplace success.